401k reduce taxable income calculator

Is a 401K a traditional IRA is no. With catch-up provisions individuals 50 and older may defer up to 26000 for 2021 and up to 27000 for 2022 subject to the combined deferral and employer contribution limit.

Reduce Your Taxable Income With A 401 K Taxact Blog

There is a difference between 401K and traditional IRA accounts.

. Living in New York City adds more of a strain on your paycheck than living in the rest of the state as the Big Apple imposes its own local income tax on top of the state one. The age ranges are based off of the age of the head of household who is typically the primary income earner. Type of federal return filed is based on your personal tax situation and IRS rules.

If you file as single on your federal income tax return and your combined income is. Tax-deferred 401ks reduce taxable income now. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors.

SIMPLE 401k for businesses employing fewer than 100 people Safe Harbor 401k in which employees always own 100 of any money their employer contributes Traditional 401k popular with companies that have large workforces One-participant 401k. The bracket you fall into is determined by your filing status and taxable income income minus deductions. This is unlike deductions which only reduce taxable income.

As mentioned earlier these accounts provide tax savings while also. Up to 20500 in 2022 or 27000 if youre 50 years of age or over. On the other hand contributions to a 401k both from employees and employers are always tax-deductible because they reduce taxable income lowering total taxes owed.

North Dakota Taxable Income Rate. A Self-Employed 401k may substantially reduce your current income taxes because generally you can. You earned 90000 a year in taxable income in 2021 - so youre in the 24 tax rate band.

Several variations of tax-deferred 401ks exist. If you have more than 523600 in income for 2021 your income will have spilled into all seven buckets but only the money sitting in the last bucket is taxed at the highest federal income tax rate of 37. Long Term Disability Insurance Life Insurance.

You can also impact your paycheck by lowering your overall taxable income. The way that the age ranges work is to limit the results to the age. An IRA is an individual retirement account.

SmartAssets Ohio paycheck calculator shows your hourly and salary income after federal state and local taxes. As a result a tax credit is generally more effective at reducing the. If you are self-employed compensation means earned income.

The 2021 standard deduction allows taxpayers to reduce their taxable income by 4500 for single. Adding your 26340 doesnt push you up into the next tax rate band so youll pay 24 tax on 26340 - a total of 6322. After deducting the 401k and IRA contributions the health savings account contributions and the capital loss deduction the Jacksons manage to reduce their 113750 earned income down to an adjusted gross income of 36550.

The contribution limits for Roth 401ks are the same as for traditional 401ks. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation. For the 2021 tax year you must file a state income tax return if you filed a federal income tax return or if your income was above the following amounts.

Our calculator doesnt consider both 401k and IRA deductions due to the tax law limitations. You can do this by contributing to pre-tax retirement accounts like a 401k or. SmartAssets Vermont paycheck calculator shows your hourly and salary income after federal state and local taxes.

To keep your taxable income lower when youve taken a 401k withdrawal and also possibly stay in a lower tax. Our income tax calculator calculates your federal state and local taxes based on several key inputs. While both plans provide income in retirement each plan is administered under different rules.

For 2022 the limit is 20500 for those under 50 and 27000 for those over 50. Working with an adviser may come with potential downsides such as. However traditional 401k contributions or deferrals reduce your current taxable income which reduces your current taxes Roth 401k contributions dont do this.

Simply add up your households annual income such as your salary your spouses salary bonus business income and windfall events then enter it into the calculator. Your household income location filing status and number of personal exemptions. SmartAssets North Dakota paycheck calculator shows your hourly and salary income after federal state and local taxes.

A 1000 tax credit will reduce a tax liability of 12000 to 11000. A 401K is a type of employer retirement account. This calculator estimates the average tax rate as the state income tax liability divided by the total gross income.

This marginal tax rate means that your. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. Your average tax rate is 1198 and your marginal tax rate is 22.

Long Term Disability Insurance Life Insurance. Common sources of retirement income that are taxable include. You can also lower your taxable income by saving more in a 401k 403b HSA or FSA.

Read about 10 ways to help reduce the taxes you pay on 401k withdrawals. Some calculators may use taxable income when calculating the average tax rate. Using the brackets above you can calculate the tax for a single person with a taxable income of 41049.

Since the tax bill is likely to pass the first 12000 in taxable income will be within the standard deduction. The first 9950 is taxed at 10. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

If you make 70000 a year living in the region of Ohio USA you will be taxed 10957. Between 25000 and 34000 you may have to pay income tax on up to 50 of your Social Security benefits More than 34000 up to 85 of your Social Security benefits may be taxable. High contribution limits401ks have relatively high annual contribution limits.

Heres an overview of how 401k taxes work how to avoid tax penalties and how to reduce your 401k taxes if the IRS wants a cut of your retirement savings. The answer to your question. Personally I would plan on failing to claim enough deductions to get to about 12200 or so in taxable income pay 10 on 200 or so 20 and claim the maximum health insurance premium subsidy.

Pin By Skashchenko Albert On Baby Budgeting Money Money Saving Plan Money Saving Strategies

:max_bytes(150000):strip_icc()/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

How Do 401 K Tax Deductions Work

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Pin On Good Governance Modi Style

Pin On Taxes

Solo 401k Contribution Limits And Types

When You Get To The End Of March There Are A Bunch Of Tax Forms That You Should Have From People D Personal Finance Budget Personal Finance Money Saving Tips

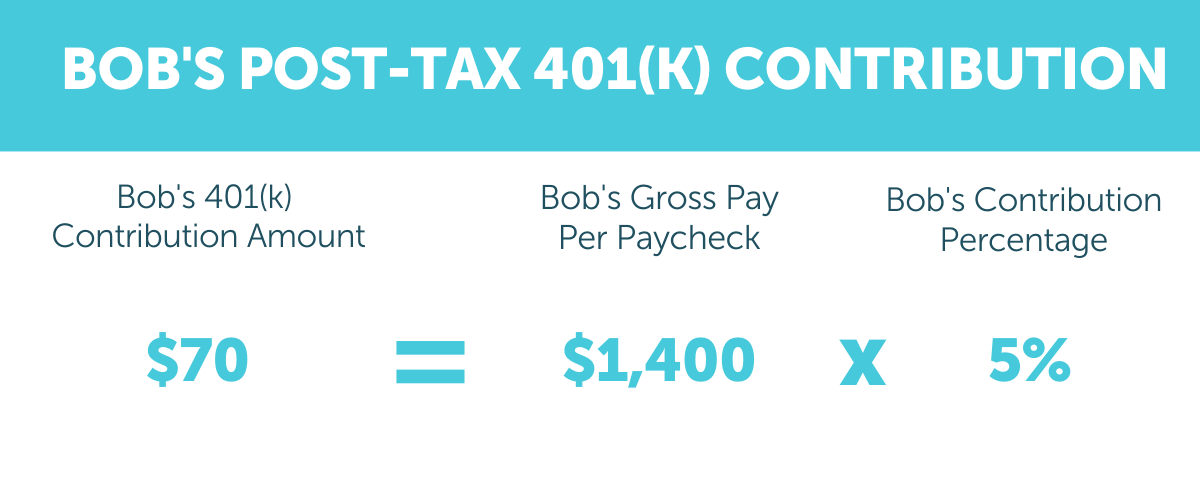

After Tax 401 K Contribution Definition How It Works Pros And Cons

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

How Much Can I Contribute To My Self Employed 401k Plan

Does Contributing To 401k Reduce Taxable Income Dakotapost

Retirement Savings Spreadsheet Spreadsheet Savings Calculator Saving For Retirement

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Can A Solo 401 K Reduce Self Employment Tax Ira Financial Group

How Does A Debt Snowball Work Credit Card Interest Rate Ideas Of Credit Card Interest Rate Creditcard Int Debt Snowball Debt Calculator Money Management

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business