Free payroll calculator 2020

Switch to hourly calculator. The entire HR operations run directly on a corporate communication software eg.

Payroll Tax What It Is How To Calculate It Bench Accounting

Filing Status Children under Age 17 qualify for child tax credit Other Dependents.

. PHP Payroll is a free employee attendance and payroll software specifically designed for medium and small enterprises. Get the latest financial news headlines and analysis from CBS MoneyWatch. Info because these types of companies switch that up throughout the day and need the info for job costing as well as payroll.

Unlimited users free forever. Offer valid for returns filed 512020 - 5312020. Choose Tax Year and State.

As of 2020 there were about 65 million individuals receiving Social Security benefits. Get up and running with free payroll setup and enjoy free expert. QuickHR frees HR professionals from tedious administrative tasks to focus on what they do best- build.

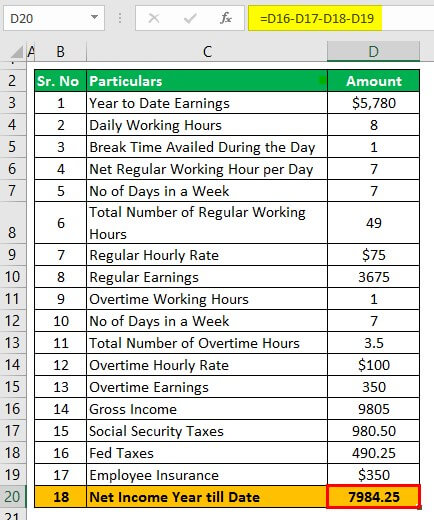

One of the most powerful things about this spreadsheet is the ability to choose different debt reduction strategies including the popular debt snowball paying the lowest balance first or the debt avalanche paying the highest-interest first. Asanify believes in the principles of AWE Agile. A dynamic Excel template for calculating employee working hours and overtime.

A separate payroll tax of 145 of an employees income is paid directly by the employer and an additional 145 deducted from the employees. Best of all its FREE if you have less than 10 employees. Tax Year for Federal W-4 Information.

Check if you have multiple jobs. Patriot will e-File 1099s for Full Service Payroll customers who are paying contractors through payroll at no additional cost for 2020 1099s and later years. Ease in payroll taxing process ie withholding employees tax filing and paying tax as per regulations.

Payroll Payroll services and support to keep you compliant. 2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents. Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE.

National Employment Matrix - Occupation. QuickHR is a Human Resource Management System HRMS thats been built with a simple goal- eliminate the problems that plague traditional HR platforms. Fast easy and intuitive payroll processing.

However we recommend using spreadsheet software in combination with a payroll calculator and only if you have 15 or fewer employees. Other Income not from jobs Other Deduction. Motivate your employees with a delightful interface.

Just choose the strategy from a dropdown box after you. The Bureau of Labor Statistics is the principal fact-finding agency for the Federal Government in the broad field of labor economics and statistics. Tax Year for Federal W-4 Information.

Other Income not from jobs Other Deduction. You should also be super confident in your document organization skills. Use our free check stub maker with calculator to generate pay stubs online instantly.

You should also check your states department of revenue website. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques. If the return is not.

We also offer a 2020 version. Full retirement age. Everything you need to manage your greatest asset.

Every part is designed with security stability and ease-of-use in mind. Download FREE Excel Timesheet Calculator Template. Fairness transparency in human resources and payroll management Engage.

An updated look at the New York Yankees 2022 payroll table including base pay bonuses options tax allocations. Inflation Easily find out how the buying power of the dollar has changed over the years using the. Choose Tax Year and State.

Number of 1099s Fee. The most popular free time tracker for teams. If you compute payroll manually your employee has submitted a Form W-4 for 2020 or later and you prefer to use the Wage Bracket method use the worksheet below and the Wage Bracket Method tables that follow to figure federal income tax withholding.

An updated look at the Colorado Rockies 2022 payroll table including base pay bonuses options tax allocations. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. SSA also provides a life expectancy calculator to help with retirement planning.

If you have Accounting Premium Accounting Basic or Basic Payroll here are the filing fees. Use this simplified payroll deductions calculator to help you determine your net paycheck. Filing Status Children under Age 17 qualify for child tax credit Other Dependents.

Tax Deducted at Source TDS Profession Tax Slabs. Extensive reporting allows generating reports in graphical and tabular form. Estimate your tax refund with HR Blocks free income tax calculator.

Clockify is a time tracker and timesheet app that lets you track work hours across projects. Employees State Insurance ESI Direct Deposits Workflow. Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later.

Time tracking software used by millions. 2020 and projected 2030 employment job openings education training and wages. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

Using Excel Google Sheets or a free payroll program is undoubtedly the cheapest way to process payroll. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. 2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents.

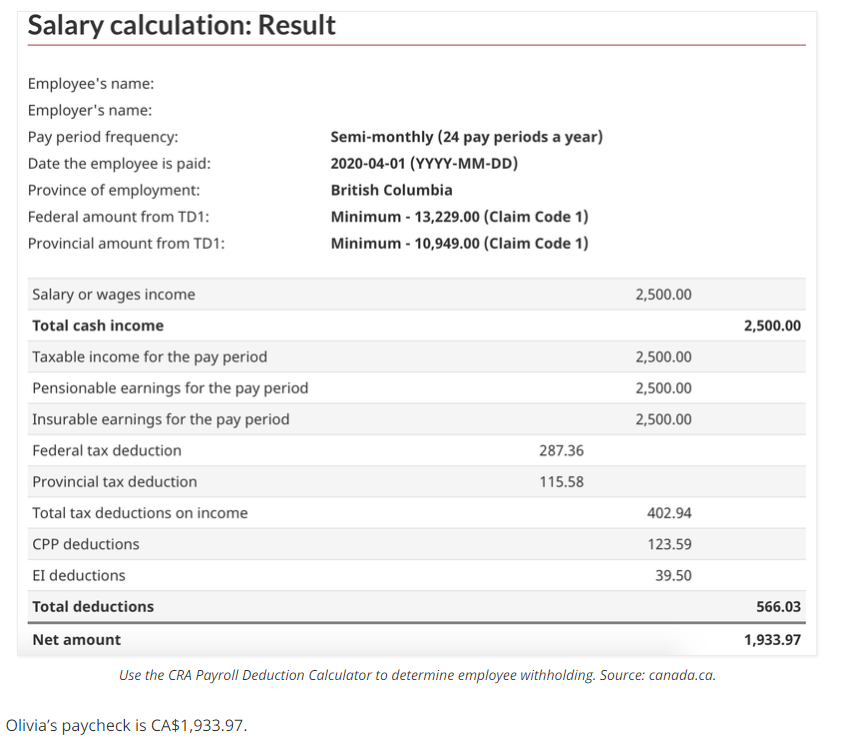

Error-free and fully compliant payroll process. Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions. Learn how you can save 100s or even 1000s of dollars.

What I was looking for to help my payroll concerns. Try paystub maker and get first pay stub for free easily in 1-2-3 steps. Check if you have multiple jobs.

2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents. October 2020 at 836 pm How to add noon time in and out for timesheet template. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

An updated look at the Baltimore Orioles 2022 payroll table including base pay bonuses options tax allocations. Making Human Resources processes agile is important to reduce waste.

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Everything You Need To Know About Running Payroll In Canada

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly Paycheck Calculator Step By Step With Examples

Free Online Paycheck Calculator Calculate Take Home Pay 2022

10 Best Free Payroll Calculator In India Fy 2021 22 Paycheck Calculator

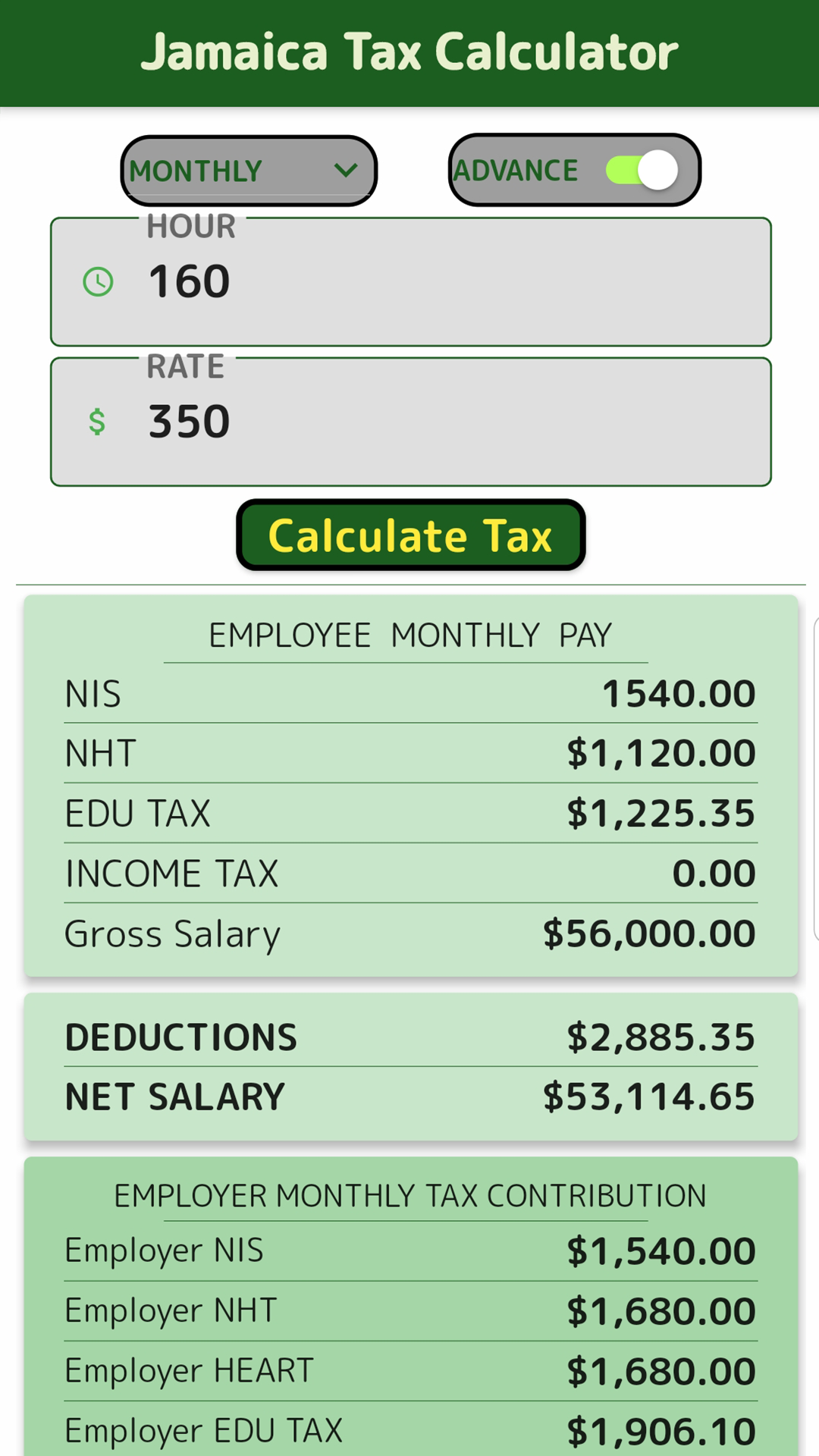

Jamaica Tax Calculator It S All Widgets

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Paycheck Calculator Step By Step With Examples

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator Free Employee Payroll Template For Excel

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager